Latest NEWS

- Aswat Masriya, the last word

- Roundup of Egypt's press headlines on March 15, 2017

- Roundup of Egypt's press headlines on March 14, 2017

- Former Egyptian President Hosni Mubarak to be released: lawyer

- Roundup of Egypt's press headlines on March 13, 2017

- Egypt's capital set to grow by half a million in 2017

- Egypt's wheat reserves to double with start of harvest -supply min

- Roundup of Egypt's press headlines on March 12, 2017

CBE governor Tarek Amer discusses economic reform after currency float

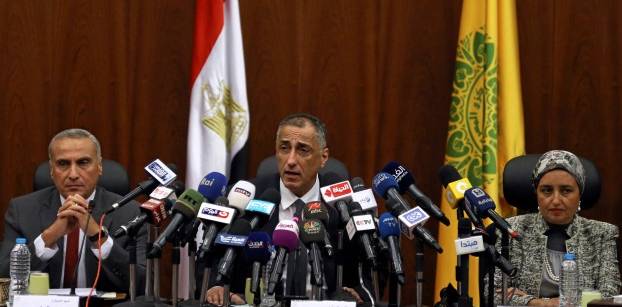

Egypt's Central Bank Governor Tarek Amer (C) speaks at a news conference in Cairo, Egypt, November 3, 2016. REUTERS/Mohamed Abd El Ghany

CAIRO, Nov 3 (Aswat Masriya) - Egypt's central bank governor Tarek Amer said on Thursday that the banking sector will take charge in determining the exchange rate, stressing that the existence of a parallel market "cannot continue".

In a press conference at the central bank headquarters, Amer talked about the ramifications of a currency flotation and the reasons behind the surprise move.

The move would allow banks to regain foreign currency, which has been circulating on the parallel market, Amer said.

The Central Bank of Egypt (CBE) set a provisional rate of 13 pounds to the dollar, plus or minus 10 per cent, on Thursday morning. The provisional rate was only set as a "transitional one", leaving the exchange rate to be determined by Egyptian banks after the exceptional auction of $100 million took place.

"This is a turning point in the economic future of the nation," Amer said as he listed the economic objectives for the coming period, namely rebuilding foreign reserves and providing funds for development, education and health purposes.

Amer affirmed the central bank's abidance by the flexible exchange rate system, with no restrictions placed on USD transactions in the banking sector.

He also stressed that safeguarding the low-income sector was a priority in the reform programme, saying that a 6-months reserve of basic goods is made available.

The central bank governor said that a funding gap of $16.3 in the fiscal year 2016/ 2017 is expected to be plugged by contributions from the International Monetary Fund (IMF), the G7 countries, China and some Arab states.

Egypt awaits approval by the IMF's board of a three-year loan program. IMF chief Christine Lagarde stated last week that there was a currency crisis in Egypt, citing the 100 per cent differential between the official and the unofficial rates.

The country's economic reform programme, which Amer says has been communicated with the IMF, included a devaluation of the pound and painful subsidy cuts.

However, cutting energy subsidies, which is among the IMF's demands, has yet to come about, with Amer saying that it was up to the government to decide on the matter.

Egypt's resort to the IMF, according to Amer, was mainly to re-establish the credibility of the Egyptian economy and to regain the trust of foreign investors.

The IMF said late October that the board's approval of the three-year $12 billion loan programme is expected in the next few weeks.

Foreign reserves have reached $19.59 billion at the end of Sept., the highest in over a year but still more than 40 per cent below levels before the January 2011 uprising.

In the past 2 months, foreign reserves have increased by $4 billion, according to Amer.

He previously announced a target of about $25 billion in foreign reserves to be reached by year-end. In response to a question by a reporter in the press conference this target still stands.