Latest NEWS

- Aswat Masriya, the last word

- Roundup of Egypt's press headlines on March 15, 2017

- Roundup of Egypt's press headlines on March 14, 2017

- Former Egyptian President Hosni Mubarak to be released: lawyer

- Roundup of Egypt's press headlines on March 13, 2017

- Egypt's capital set to grow by half a million in 2017

- Egypt's wheat reserves to double with start of harvest -supply min

- Roundup of Egypt's press headlines on March 12, 2017

Egypt's economy under Sisi: Two years of fluctuations

CAIRO, Jun 14 (Aswat Masriya) – The Egyptian economy has witnessed fluctuations over two years of President Abdel Fattah al-Sisi’s presidency. While some of the main economic indicators improved, and Egyptians’ standard of living has worsened due to the rise in prices and the decline in the local currency’s value.

President Sisi assumed his position in June 2014 at a time when the central bank was adopting a monetary policy that relied on the gradual floating of the Egyptian pound. The central bank started adopting this policy in 2012, the first and only year of former president Mohamed Mursi’s rule.

The central bank adopted such policy through holding auctions where it sold U.S. dollars to banks in an attempt to gradually narrow the gap between the official exchange rate and the black market’s unofficial rate.

In the second half of 2014, the dollar's official exchange rate continued to hover around EGP 7.14 until the central bank moved the dollar up to EGP 7.53 in the first weeks of 2015. By the end of Hisham Ramez’s term as central bank governor, the dollar reached 7.93 to the pound before appreciating by 20 piastres during the incumbent governor Tarek Amer’s term.

However, the gap between the official market and the parallel market remained wide, with Bloomberg estimating the difference at 24 per cent in March.

This prompted the central bank to impose a sudden depreciation of the pound on Mar. 14 through a floating that raised the dollar’s value to the local currency to reach EGP 8.78.

The sudden move temporarily narrowed the gap between the official rate and the unofficial rate to reach 3 per cent; however, the gap widened again shortly after to reach 29 per cent in April.

The crisis of the Egyptian pound is connected to the weak flow of foreign currency, which reached its lowest point after the January 2011 Uprising. At the start of Sisi’s term,the foreign reserves were halved from $36 billion to $16.6 billion.

Foreign reserves have fluctuated during Sisi’s term, increasing slightly by virtue of Gulf aid and decreasing in the absence of such aid.

Egypt’s net foreign reserves have reached $17 billion as of April 2016, which is close to the figure Sisi commenced his term with.

The weakness of the pound, as well as the weak flow of foreign currency into the country, contributed to the rise in commodity prices in light of Egypt's heavy reliance on importing final components and production inputs.

Rising inflation, improved growth

In this context, the annual rate of increase in consumer prices rose from 8.2 per cent when Sisi took office to 10.9 per cent in April.

According to the Central Agency for Public Mobilisation and Statistics, inflation rates have increased from 11.2 per cent in June 2014 to 13.5 per cent in April.

In contrast to the rising prices, the unemployment rate has declined from 13.3 per cent of the labour force in June 2014 to 12.7 per cent in March, thus relieving some of the pressures of inflation.

The retreating unemployment rate was also supported by the relative improvement of the economic growth rate during Sisi's term, as it increased from 2.2 per cent in FY 2013/2014 to 3.1 per cent in the following fiscal year, according to central bank figures.

The growth was triggered by certain sectors including construction, which witnessed a development of about 9.7 per cent in 2014/2015, and tourism which rose to 19.5 per cent.

However, the growth rate in the period from July to December 2015 retreated to 2.7 per cent, mainly affected by the decline in tourism as the sector shrank in the last few months of 2015 to 15 per cent.

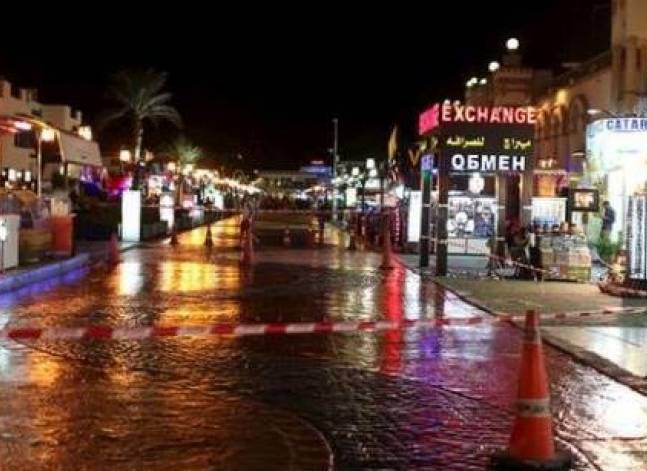

The tourism sector was negatively affected in the aftermath of the crash of the Russian jetliner in October 2015. This led to a decline in the number of tourists visiting Egypt from 909,000 tourists in the month of the crash to 347,000 in February.

(This article was translated into English by Nourhan Fahmy.)